Payanywhere and Square both offer solid payment processing solutions, but Square is the clear winner.

If you want reliable transactions, better software, and an easy-to-use platform, Square is your best bet.

Payanywhere has some appealing perks, like lower in-person transaction fees and free basic hardware, but it falls short on reliability, integrations, and customer support.

If you're serious about running a business, you need a payment processor that won’t give you headaches.

And from everything I’ve tested, Square delivers a smoother experience.

Payanywhere vs Square: Quick Comparison

| Feature | Square | Payanywhere |

|---|---|---|

| Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ |

| Best For | Small businesses, e-commerce, freelancers | Low-cost in-person transactions |

| Hardware | POS systems, card readers, registers | Free basic reader, terminals |

| Transaction Fees | 2.6% + $0.10 (in-person) | 2.69% (in-person) |

| Payout Speed | 1-2 business days (instant for a fee) | 1-2 business days |

| Integrations | Shopify, QuickBooks, WooCommerce | Limited |

| Customer Support | 24/7 chat, phone support | Mixed reviews |

Now, let’s break it down further.

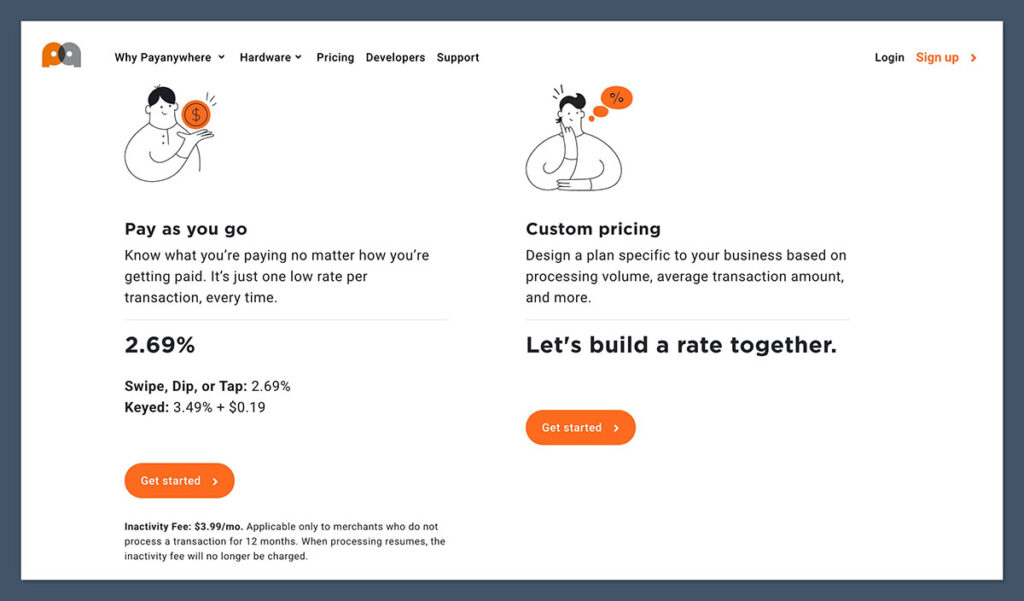

1. Payment Processing & Fees

✅ Square: Simple, transparent pricing with flat-rate fees.

✅ Payanywhere: Lower in-person rates but higher fees for manually entered payments.

- Square Fees:

- In-person: 2.6% + $0.10 per swipe/tap

- Online: 2.9% + $0.30 per transaction

- Manually keyed-in: 3.5% + $0.15

- Payanywhere Fees:

- In-person: 2.69% per swipe/tap

- Online: 3.49% + $0.19

- Manually keyed-in: 3.49% + $0.19

Payanywhere's in-person fees are slightly better, but when you look at the bigger picture, Square's flat-rate model is more predictable and business-friendly.

The problem with Payanywhere is the hidden costs—while the swipe fees seem lower, once you factor in manual transactions and online payments, it can actually end up costing more.

If you ever need to process a keyed-in payment, you're looking at a significant price jump with Payanywhere, which isn't ideal if you take orders over the phone or manually enter transactions.

Square, on the other hand, is upfront about its costs and makes it easy to calculate expenses. Their pricing structure is transparent and easy to understand, so you're never surprised by unexpected charges.

Plus, Square's reporting tools help track how much you're spending on fees over time. This makes it a better long-term option for businesses that want financial clarity.

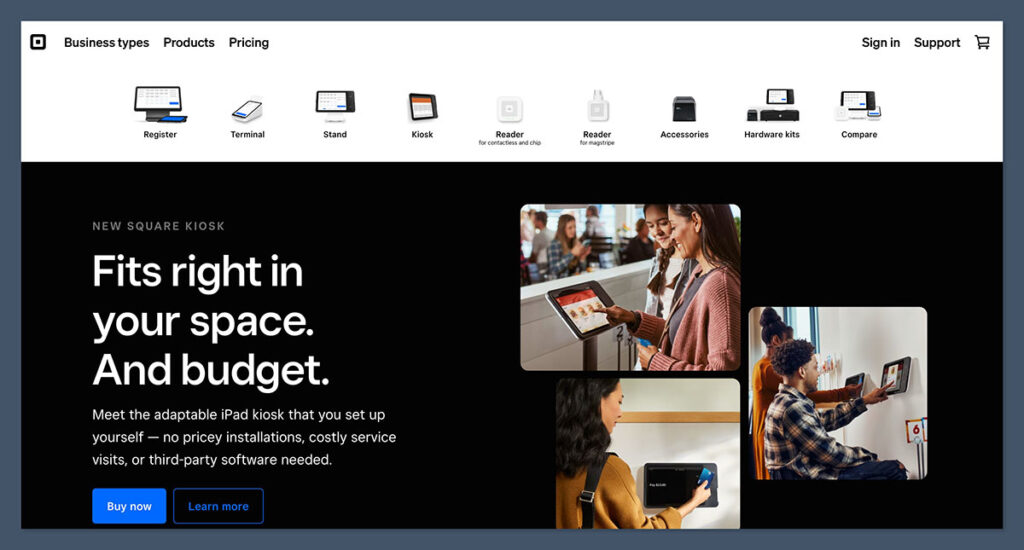

2. Hardware & POS Features

✅ Square: Best for growing businesses, with top-tier POS systems and software.

✅ Payanywhere: Free reader for new users, but fewer options overall.

Square Hardware Options:

- Free magstripe reader

- Square Reader for contactless & chip ($49)

- Square Stand ($149)

- Square Terminal ($299)

- Square Register ($799)

Payanywhere Hardware Options:

- Free magstripe reader

- Smart Terminal ($9.95/month rental)

- Smart Flex and Smart Point of Sale options

Square's hardware is more advanced and reliable, making it a better option for businesses looking for a seamless checkout experience.

Whether you need a basic reader or a full register setup, Square has you covered with multiple options.

Their terminals are highly responsive, durable, and integrate smoothly with their software, ensuring fewer transaction hiccups.

If you're running a busy business, you don't want your system lagging or crashing in the middle of a sale—and Square's hardware is built to handle high volumes without issues.

Payanywhere's hardware is cheaper upfront—especially with the free basic reader—but the limited options can hold your business back.

Their Smart Terminal is a decent option for smaller businesses, but the monthly rental fee adds up over time. If you're looking for a one-time purchase option with no recurring fees, Square is the better investment.

3. Payout Speed & Reliability

✅ Square: Instant deposits available, otherwise 1-2 business days.

✅ Payanywhere: Standard 1-2 day deposits, but account holds are common.

One of the biggest issues with Payanywhere is that many users report frozen accounts and withheld funds. If you need consistent cash flow, this could be a deal-breaker.

Square’s instant deposit feature is a game-changer for businesses that need access to funds quickly.

For a small fee, you can transfer money instantly to your bank account, which can help with cash flow, payroll, and covering expenses.

This flexibility gives Square a major edge, especially for businesses that rely on steady cash flow.

Payanywhere, on the other hand, has a history of unreliable payouts, with many business owners reporting funds being held for weeks or even months.

If you’re running a business, you can’t afford to have your money tied up without explanation. This is one of the biggest risks of choosing Payanywhere over Square.

Final Verdict: Which One Should You Choose?

- If you want the best overall experience → Square is the way to go.

- If you need the lowest swipe fees and don’t take online payments → Payanywhere might be a better option.

- If you need reliable cash flow and great support → Stick with Square.

Square’s combination of transparent pricing, reliable hardware, fast payouts, and strong integrations makes it the best choice for most businesses.

Payanywhere might be tempting for its lower in-person fees, but the risks outweigh the benefits.

Unless you only process card-present transactions and never need customer support, Square is the better and safer long-term option.

Comments 0 Responses